Have A Tips About How To Sell Rights Issue

The existing shareholders can take up all of their allocated rights.

How to sell rights issue. The market may interpret a rights issue as a warning sign that a company could be struggling. The shareholders not willing to subscribe to their rights issue can sell their rights in the open market through the rights entitlement trading platform of the stock exchange or via. Shareholders have four options when presented with a rights issue:

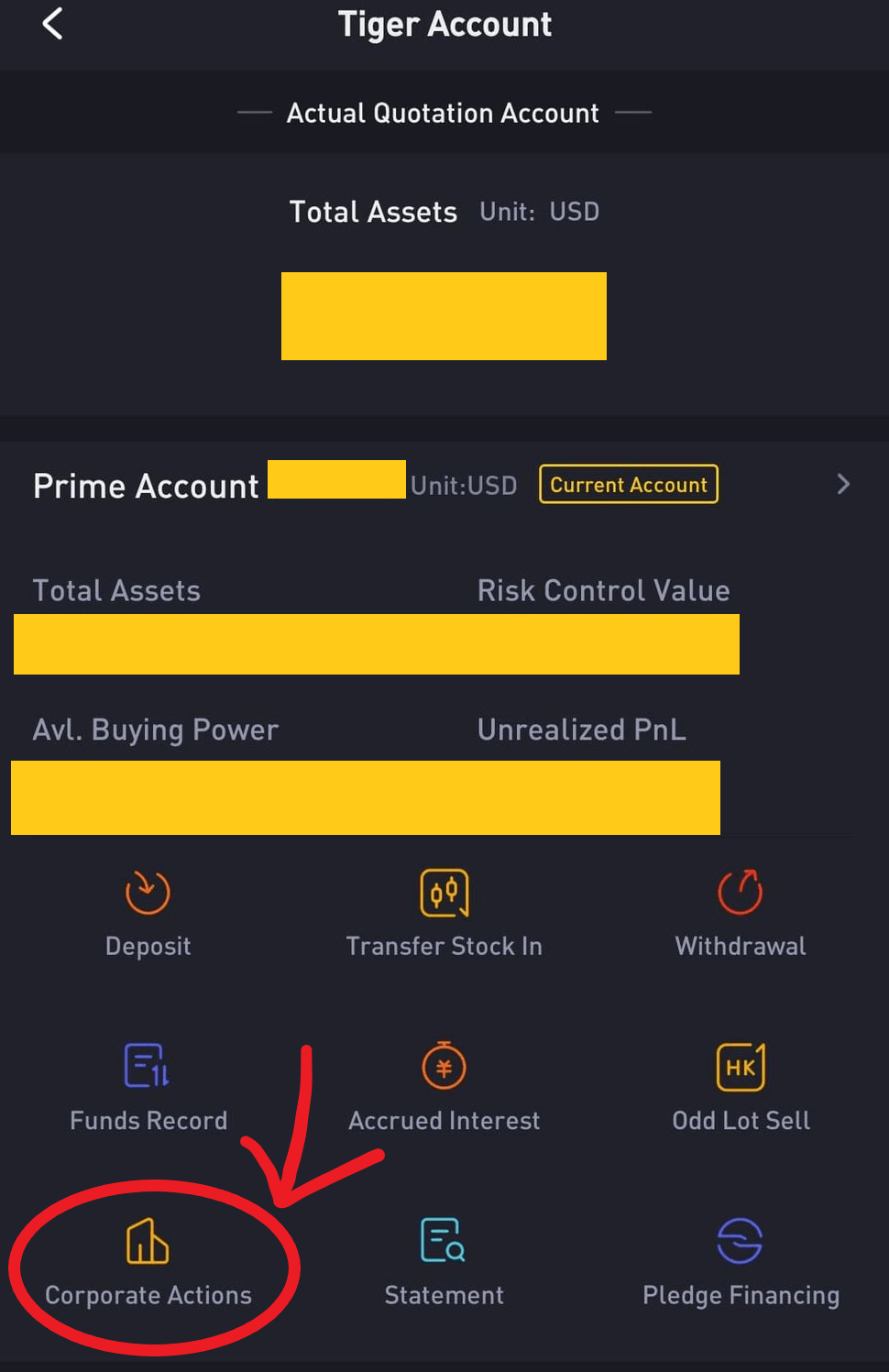

If a shareholder wants to sell their rights issue, they can do so through a broker. To calculate the number of rights you need to sell to buy the maximum number of shares, you can perform the following calculation: The pros of this are that the shareholder can get rid of their rights quickly and.

You can even use the proceeds from selling some of your rights to take up your. Rights offering how a rights offering (issue) works in a rights offering, each shareholder. If you don’t want to exercise the rights, you should sell them off.

Shareholders have many options to react to the management decision of the rights issue. If you assume mcbs 2020 and 2021 all vest in full, the dilution is up to 5.5 times. After the 2020 rights issue, sia’s share count has increased by 2.5 times.

This might even cause investors to sell their shares, which would. You can buy and sell them like a normal stock. Adding the total values together $8,000 + $3,000 = $11,000.

Is rights issue good or bad? Sell part of your rights to other investors another option is to sell part of your rights. If you want to buy more shares you can also buy more rights.